Automaker Solid-State Battery Race: Breakthrough or Buzzword?

Introduction

The electric vehicle (EV) industry is abuzz with talk of solid-state batteries, heralded as the next big leap in battery technology. Promising longer ranges, faster charging, and enhanced safety, these batteries have automakers racing to bring them to market. But with ambitious timelines set for 2026–2027 and lingering technical hurdles, is the solid-state revolution imminent, or is it just hype? Let’s dive into the global push for solid-state batteries and what it means for the future of EVs.

The Solid State Battery EV Race to 2026

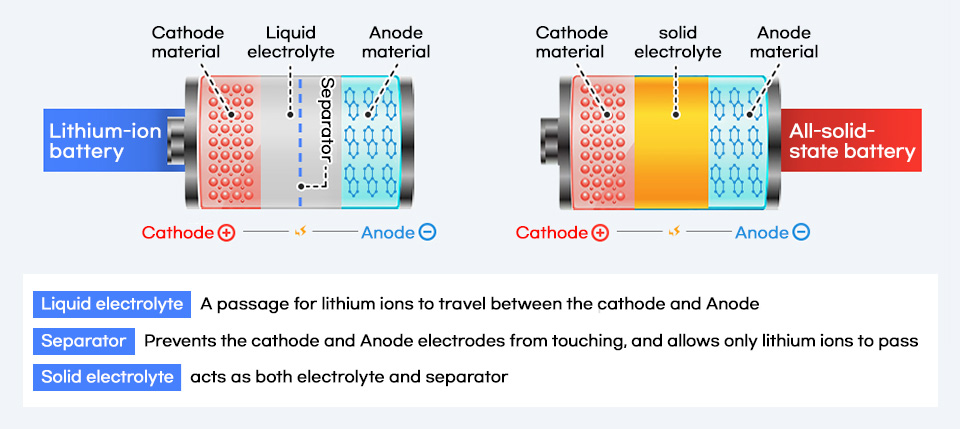

Solid-state batteries, which replace liquid electrolytes with solid ones, offer significant advantages: energy density up to 450 Wh/kg, ranges exceeding 600 miles, and near-elimination of fire risks. Major automakers are betting big on this technology, with 2026–2027 emerging as pivotal years for initial vehicle integration.

In China, the charge is led by companies like Xiaomi, which recently patented a solid-state battery design, signaling its ambition to integrate the tech into its EVs by 2027. Changan aims to debut solid-state-equipped prototype vehicles this year, with mass production targeted for 2027. SAIC, partnering with QingTao Energy, plans to scale up to 100,000 solid-state-equipped vehicles by 2025, starting with its IM Motors L6 model featuring a “quasi-900V” fast-charging system. BYD, a heavyweight in the battery space, is set to begin road tests in 2027, aiming for large-scale adoption by 2030.

Globally, the competition is fierce. Mercedes-Benz, collaborating with Factorial Energy, is testing its “Solstice” battery, targeting a 600-mile range and 40% weight reduction, with production planned for 2030. BMW and Toyota are also in the race, with road tests underway and commercialization eyed for 2028–2030.

However, not all claims are equal. Some automakers tout “solid-state” batteries that are actually semi-solid or quasi-solid, containing up to 10% or 5% liquid electrolyte, respectively. True solid-state batteries, with less than 1% liquid, remain a tougher challenge. Industry leader CATL has called out such marketing tactics, estimating that true solid-state mass production may take until 2035.

Image 2: Electric Vehicle with Solid-State Battery

Below is a chart comparing the energy density and projected timelines of solid-state batteries from key players in the race.

| Automaker | Scaling Timelines |

|---|---|

| Changan | 2025 first launch with national battery sample vehicles, 2026 mass production vehicle trials, 2027 promote national battery gradual mass production |

| SAIC | SAIC’s first national battery, Yiqi battery, will be implemented in 2027 |

| GAC | Plans to be the first to equip Haobo models with batteries in 2026 |

| Chery | 2026 will equip designated models with national batteries, and fully promote them by 2027 |

| BYD | Around 2027, start national battery mass production and commercialization, and achieve large-scale vehicle integration after 2030 |

| Mercedes-Benz | August 2026, conduct initial national battery vehicle trials on Dongfeng passenger and Dongfeng Nano models |

| BMW | February 2025, EQS prototype with national battery technology has started road testing; mass production of national batteries before 2030 |

| Tesla | May 2025, BMW i7 test model with national battery technology officially started road testing in Munich |

| Toyota | After 2030, commercialize national batteries |

| Kia | 2025 establish a pilot factory for national battery production, first vehicle integration in 2028, and gradually achieve mass production |

| Honda | Before 2030, achieve mass production and vehicle integration |

Technical and Cost Challenges

The allure of solid-state batteries lies in their potential: 10-minute charging, 10,000+ cycles, and unmatched safety. Yet, significant hurdles remain. Manufacturing solid-state batteries is complex, requiring new materials and processes to ensure stable solid-solid interfaces and high ionic conductivity. Current costs are steep—around $200–300/kWh compared to $70/kWh for liquid lithium-ion batteries—making them impractical for mass-market EVs. For a 100 kWh battery pack, solid-state costs could exceed $20,000, rivaling the price of an entire vehicle.

Experts highlight unresolved issues, such as optimizing electrolyte-electrode compatibility and scaling production without compromising quality. These challenges suggest that while semi-solid batteries may hit the market by 2026, fully solid-state solutions could take a decade to mature.

Policy Support and Industry Standards

China is doubling down on solid-state development with robust policy backing. In 2025, the Ministry of Industry and Information Technology (MIIT) outlined plans to make solid-state batteries a priority, allocating approximately $800 million to support R&D by companies like CATL, BYD, and SAIC. New standards, introduced in May 2025 by the China Automotive Engineering Society, define true solid-state batteries as having less than 1% liquid electrolyte, measured by a “weight loss rate” test. This move aims to curb exaggerated claims and foster technical clarity.

Globally, capital markets are also optimistic, with solid-state battery stocks surging as investors bet on an industry turning point. These developments signal strong momentum, but the path to commercialization remains fraught with uncertainty.

Conclusion

The solid-state battery race is heating up, with 2026 poised to be a milestone year for semi-solid battery adoption. While automakers like Xiaomi, Changan, and SAIC push aggressive timelines, technical and cost barriers suggest that fully solid-state batteries may not dominate until 2030 or beyond. Backed by policy support and clearer standards, the industry is moving forward, but success will hinge on overcoming engineering challenges and resisting the temptation to overhype progress. For now, solid-state batteries are a tantalizing promise—one that could redefine EVs if the industry stays focused on substance over spectacle.