France Energy Storage Lithium Battery Market in 2025: A Comprehensive Overview

Introduction

As of 2025, France’s energy storage market, particularly in lithium battery technology, is experiencing significant growth, driven by the country’s push for renewable energy integration, grid stability, and energy independence. This article explores the current state of the France energy storage lithium battery market, focusing on key segments such as outdoor (RV, marine), residential, and commercial & industrial applications. We’ll also delve into the role of lithium-ion batteries, including Lithium Iron Phosphate (LiFePO4), and highlight the key manufacturers shaping this market.

Market Overview

In 2025, the France battery energy storage systems (BESS) market is estimated to be worth approximately USD 307 million, growing at a compound annual growth rate (CAGR) of 21.2% from 2024 to 2030, according to Grand View Research. This growth is fueled by France’s ambitious renewable energy goals, including achieving carbon neutrality by 2050, and the need for grid flexibility as solar and wind power become more prevalent. The European BESS market, of which France is a part, is projected to reach USD 15.54 billion in 2025, with lithium-ion batteries holding a dominant 92% market share in 2024, as reported by Mordor Intelligence.

Lithium-ion batteries dominate the market due to their high energy density, efficiency, and versatility. Among lithium-ion chemistries, Lithium Iron Phosphate (LiFePO4) stands out for its safety, longevity, and suitability for both residential and industrial applications. Other chemistries, such as Nickel Manganese Cobalt (NMC) and Lithium Titanate (LTO), are also used, but LiFePO4 is particularly favored for its stability and cost-effectiveness.

| Category | Details |

|---|---|

| Market Size in 2025 (France) | ~USD 307 million (estimated) |

| Growth Rate (CAGR 2024-2030) | 21.2% |

| Dominant Battery Type | Lithium-ion (92% share in Europe, 2024), including LiFePO4, NMC, LTO |

| Key Applications | Residential, Commercial & Industrial, Outdoor (RV, Marine) |

| Key Drivers | Renewable energy integration, grid stability, carbon neutrality goals |

Market Segments

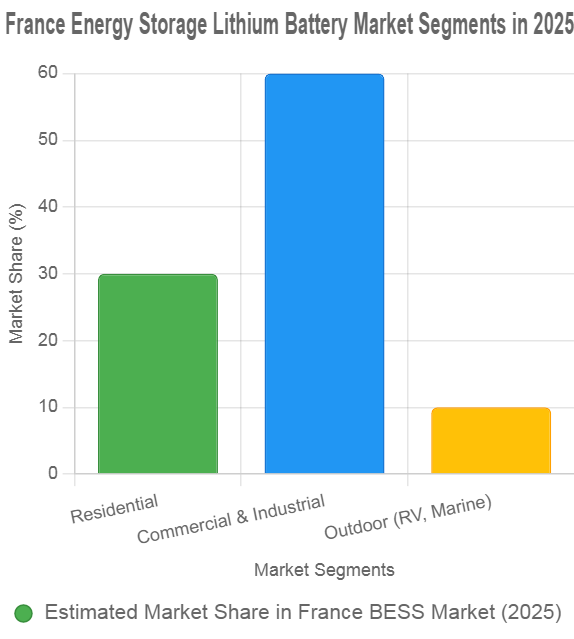

The France BESS market can be segmented based on application, with each segment playing a crucial role in the country’s energy transition. Below is a detailed breakdown:

Residential Energy Storage

- Overview: Residential energy storage systems are gaining traction as homeowners seek to reduce electricity bills and increase energy independence. These systems often pair with solar panels to store excess energy for use during peak demand or outages. The rise in electricity prices and government incentives are key drivers.

- Battery Type: Lithium-ion batteries, particularly LiFePO4, are preferred for their long cycle life (up to 5000 cycles) and enhanced safety features, making them ideal for home use.

- Market Trends: While exact figures for France’s residential segment in 2025 are not specified, Europe’s residential storage market has grown significantly, with over 1 million installations by 2022, according to SolarPower Europe. France, though lagging behind countries like Germany, is catching up due to increasing demand.

- Example: Companies like Lancey Energy Storage offer integrated battery systems for smart electric radiators, enhancing photovoltaic (PV) self-consumption in homes.

Commercial & Industrial (C&I) Energy Storage

- Overview: C&I energy storage solutions help businesses manage peak demand charges, integrate renewable energy sources, and ensure power reliability. This segment includes large-scale projects that support grid services, such as frequency regulation and peak shaving, and renewable energy integration.

- Battery Type: Lithium-ion batteries, including NMC for high energy density and LiFePO4 for safety and durability, are widely used. In 2024, the commercial segment held a significant revenue share (59.43%) in France’s BESS market, as per Grand View Research.

- Key Projects: Notable projects include Amarenco’s Amarenco-Claudia project (105 MW, 98 MWh lithium-ion) in Gironde and Corsica Sole’s 50 MW battery storage system using Tesla MegaPack technology, paired with 100 MW of solar capacity.

- Market Share: The C&I segment is the largest in France, driven by large-scale deployments and government support for grid modernization, with €15 billion allocated for smart grid technologies.

Outdoor and Mobile Applications (RV, Marine)

- Overview: The outdoor and mobile segment, though smaller than residential or C&I, is a niche market where energy storage is essential for off-grid power in recreational vehicles (RVs) and marine vessels. These applications require lightweight, durable, and safe batteries.

- Battery Type: LiFePO4 batteries are particularly popular due to their deep cycle capabilities, safety, and ability to handle frequent charging and discharging. They offer high energy density (up to 300 Wh/kg) and are well-suited for rugged environments.

- Market Trends: While France-specific data for this segment is limited, global brands like Victron Energy and Mastervolt supply lithium-ion and LiFePO4 batteries for RVs and marine use, which are also adopted in France. The segment is expected to grow as outdoor recreation gains popularity.

- Challenges: High initial costs and limited local manufacturing for specialized outdoor batteries may constrain growth, but global supply chains are filling the gap.

| Segment | Key Features | Battery Type | Market Drivers |

|---|---|---|---|

| Residential | Solar integration, energy independence, cost savings | LiFePO4, NMC | Rising electricity prices, incentives |

| Commercial & Industrial | Peak demand management, grid services, renewable integration | LiFePO4, NMC | Large-scale projects, grid modernization |

| Outdoor (RV, Marine) | Off-grid power, durability, safety | LiFePO4 | Growing outdoor recreation |

Key Manufacturers

Several companies are at the forefront of France’s energy storage market, driving innovation and deployment. Below are some key players:

- Saft (TotalEnergies): Based in Levallois-Perret, Saft is a leading provider of advanced battery technologies, including LiFePO4 batteries for residential, industrial, and grid-scale applications. Their Intensium Max 20 High Energy solution is used in projects like TotalEnergies’ 25 MWh storage system in Dunkirk.

- Amarenco: Headquartered in Lagrave, Amarenco is known for its large-scale BESS projects, such as the Amarenco-Claudia project (105 MW, 98 MWh lithium-ion), which supports grid stability and renewable integration.

- Corsica Sole: Based in Paris, Corsica Sole is developing significant solar and storage projects, including a 50 MW battery system using Tesla MegaPack technology, paired with 100 MW of solar capacity, aiming for 3 GW by 2030.

- Neoen: A Paris-based renewable energy leader, Neoen integrates energy storage with its solar and wind farms, with 8.4 GW operational and a goal of 10 GW by 2025.

- Lancey Energy Storage: Located in Grenoble, Lancey specializes in integrated battery systems for smart electric radiators and PV self-consumption, targeting residential and commercial markets.

Other notable players include global manufacturers like Tesla, LG Chem, Samsung SDI, and BYD, which supply lithium-ion batteries to France, and Hitachi Energy, involved in both battery and pumped hydro storage solutions.

| Manufacturer | Headquarters | Focus Area | Notable Projects/Products |

|---|---|---|---|

| Saft (TotalEnergies) | Levallois-Perret, France | LiFePO4, grid-scale, industrial | 25 MWh Dunkirk project |

| Amarenco | Lagrave, France | Lithium-ion, large-scale BESS | 105 MW Amarenco-Claudia project |

| Corsica Sole | Paris, France | Lithium-ion, solar + storage | 50 MW Tesla MegaPack project |

| Neoen | Paris, France | Renewable integration, storage | 8.4 GW operational, 10 GW target by 2025 |

| Lancey Energy Storage | Grenoble, France | Residential, smart radiators | Integrated battery systems for PV self-consumption |

Future Outlook

Looking ahead, France’s energy storage market is poised for continued growth. The government’s commitment to carbon neutrality by 2050, coupled with increasing renewable energy penetration (solar and wind), will further boost demand for energy

storage systems. Lithium-ion batteries, particularly LiFePO4, are expected to remain dominant due to their proven performance, with innovations targeting cycle lives exceeding 5000 cycles and higher energy densities. Emerging technologies like sodium-ion batteries may gain traction by 2027, but lithium-ion will likely lead in the near term.

France’s focus on grid modernization, with €15 billion allocated for smart grid technologies, will create new opportunities for BESS deployment. Large-scale projects, such as those by Amarenco and Corsica Sole, are setting the stage for a more resilient and flexible energy system. Additionally, regulatory frameworks, such as the EU’s Electricity Market Design Directive, are enhancing flexibility and consumer participation, further supporting market growth.

Conclusion

In 2025, France’s energy storage lithium battery market is vibrant and growing, with diverse applications ranging from residential energy independence to large-scale industrial and grid support. Lithium-ion batteries, especially LiFePO4, are at the forefront of this transformation, offering the safety, efficiency, and scalability needed for a sustainable energy future. With key players like Saft, Amarenco, and Corsica Sole driving innovation, France is well-positioned to lead in Europe’s energy storage revolution.

Citations

- [1] Grand View Research. “France Battery Energy Storage Systems Market Size & Outlook, 2030.” Accessed August 1, 2025. https://www.grandviewresearch.com/horizon/outlook/battery-energy-storage-systems-market/france

- [2] Mordor Intelligence. “Europe Battery Energy Storage System Market Size & Industry Trends 2030.” Accessed August 1, 2025. https://www.mordorintelligence.com/industry-reports/europe-battery-energy-storage-system-market

- [3] Huntkey & GreVault Battery Energy Storage Systems. “Top 10 Energy Storage Companies in France.” Accessed August 1, 2025. https://www.huntkeyenergystorage.com/top-10-energy-storage-companies-in-france/

- [4] Market Data Forecast. “Europe Lithium-Ion Stationary Battery Storage Market, 2033.” Accessed August 1, 2025. https://www.marketdataforecast.com/market-reports/europe-lithium-ion-stationary-battery-storage-market